Award-Winning Chicago Personal Injury Lawyer - Securing Justice

for Illinois Injury Victims - Over $450 Million Recovered

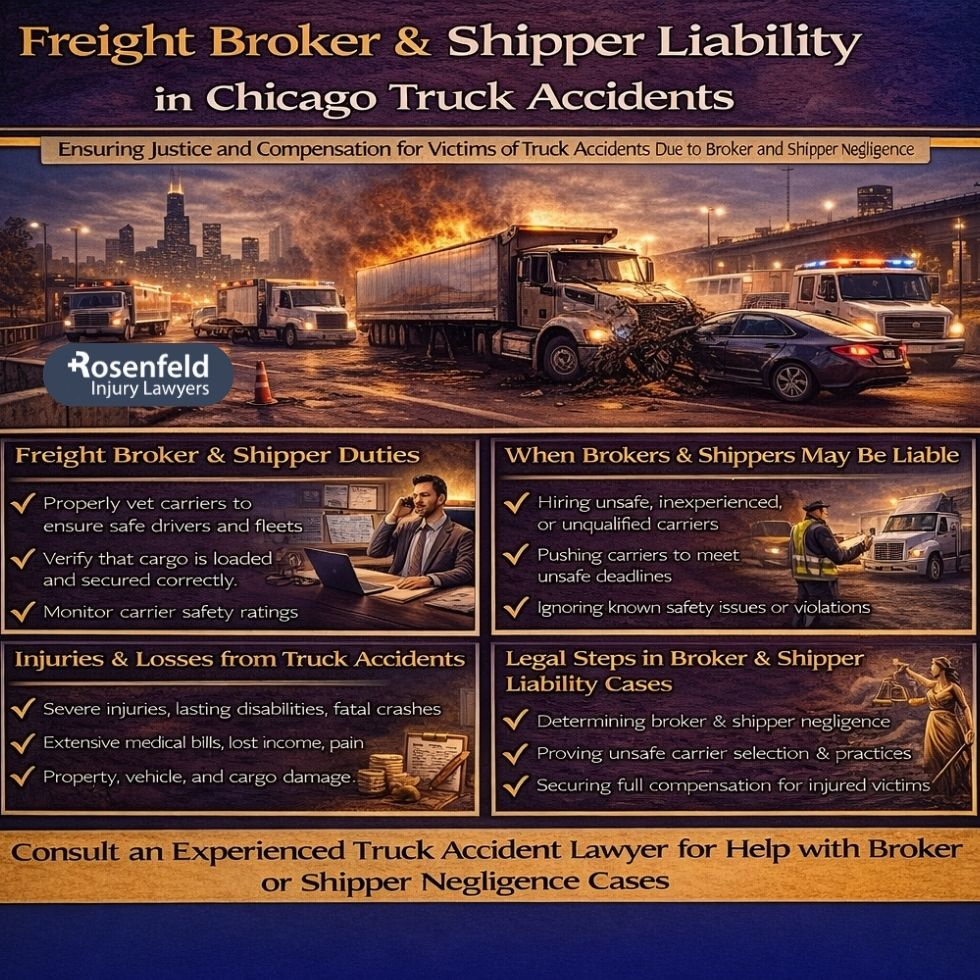

After a serious truck crash, the public story usually centers on the truck driver. But in modern transportation, the power often sits upstream. Freight brokers, third-party logistics companies, and a freight forwarder can decide which motor carrier gets the load, what deadlines apply, and how much the carrier is paid. Those decisions shape risk on the road.

This page is about freight broker and shipper liability as a distinct practice area. The core question is not only what the driver did. The key issue is who created the conditions for predictable harm by choosing unsafe carriers, rewarding cutting corners, or exercising control while still claiming a free pass because the carrier is an independent contractor.

A freight broker’s business model is simple: match shippers with carriers and keep the spread. In the trucking industry and broader transportation industry, that incentive can push brokers to save money by selecting the cheapest motor carrier that will accept the job fast. When that happens, safety to other motor vehicles becomes a line item.

This is where broker liability begins. If a broker’s selection process is rushed, superficial, or designed to protect margins instead of the public, it can create potential liability when the chosen carrier’s driver causes a truck accident.

Freight brokers often argue they cannot be responsible because the motor carrier is an independent contractor. That argument is common, but it does not always release from liability.

The legal landscape in many courts turns on control and the safety exception. The safety exception is the concept that even when a motor carrier is framed as independent, public safety obligations and state laws can still allow claims when a broker exercises control over safety-critical operations.

In practice, we look at whether the broker exercises influence over how the work is done, not just whether a contract labels someone an independent contractor. The more a broker controls timing, routing expectations, equipment requirements, or operational directives, the harder it becomes to deny responsibility when a truck crash occurs.

The most important documents in these cases are broker-carrier agreements and related contract materials. The contract language rarely tells the whole story, but it often reveals what the broker demanded and what the carrier agreed to.

We analyze whether the agreement and dispatch communications show that the broker:

Control is not a vibe. It is provable. And it sits in writing, portals, emails, and load tenders.

Broker liability often lives or dies on hiring. The theory is straightforward: if a broker selects a motor carrier with known red flags, that selection can be actionable.

Negligent selection and negligent hiring claims are not about perfection. They are about reasonable safety screening. Negligent hiring and negligent selection focus on whether the broker ignored warning signs that a reasonable intermediary would have caught.

Examples of broker-side failures that support negligence include:

When a broker fails to screen carriers responsibly, and a predictable event follows, the broker can be held liable under many state laws.

Shipper liability is different from that of freight brokers. Shippers can create risk when they control loading, scheduling, or operational realities at the dock and yard.

Shippers may face liability when they:

In some cases, a shipper’s demands effectively control the operation. That can change the analysis of who is responsible for the accident and who can be held accountable.

The safety exception is not a slogan. It is how courts evaluate whether public safety rules and state laws permit claims against brokers who try to hide behind paperwork.

We build the safety exception argument by showing:

When a court determined that a broker’s conduct crossed the line into actionable negligence, broker liability becomes real, not theoretical.

Vicarious liability is the doctrine that one party can be held responsible for another’s conduct in certain relationships. Brokers usually resist this aggressively because it expands exposure.

We analyze whether the facts support a theory that the broker should be held vicariously liable based on the nature of control and the relationship to the carrier’s driver. In some cases, the evidence supports an argument that the broker is not a passive intermediary but an entity directing the transport operation.

This is where the phrase held vicariously liable becomes a live issue, not just a legal phrase.

Defense teams often try to narrow the case to the driver’s negligence alone. We do not let them. A truck accident frequently reflects upstream decisions by brokers and shippers.

We look for proof that:

This is how we connect a real-world crash to corporate conduct in transportation.

Broker liability cases often involve preemption arguments tied to interstate commerce and federal law. Freight brokers frequently argue that claims are barred because the transportation network crosses state lines, and they invoke Supreme Court-focused framing to reshape what state laws can do.

That does not mean brokers are immune. The legal landscape is actively litigated, and courts analyze whether state laws targeting safety fall within a safety exception rather than being preempted. When a ruling recognizes safety-based claims, the path to liability remains open.

Robinson Worldwide is often cited in discussions of freight broker liability because disputes can turn on what the broker knew, what the broker controlled, and how the broker selected carriers.

In a case where a court concluded that broker conduct was purely match-making with no control, the broker may escape. In a different case where a court determined that the broker was negligent in selection, the analysis changes.

That is the practical lesson: broker liable outcomes are fact-driven. Your truck accident lawyer has to build the control record and the selection record from contracts, portals, and testimony.

When brokers and shippers are properly added, the case is not just bigger. It is more accurate. It reflects who actually shaped the risk.

Potential claims can include compensation for medical harm, lost income, and long-term impact. The goal is full compensation, based on the evidence and the true chain of responsibility.

These cases are paperwork-heavy for a reason. Freight brokers and carriers operate in systems that log everything, then purge it. You need action early.

We move quickly to preserve:

If you were injured in a truck accident involving a tractor-trailer, and you suspect a broker or shipper played a role, contact our office for a consultation with a personal injury lawyer. We build cases against trucking companies by proving control, exposing negligent selection, and using the safety exception to hold intermediaries accountable.

All content undergoes thorough legal review by experienced attorneys, including Jonathan Rosenfeld. With 25 years of experience in personal injury law and over 100 years of combined legal expertise within our team, we ensure that every article is legally accurate, compliant, and reflects current legal standards.